Wise Payment System: A Comprehensive Guide

Understanding the financial tools at our disposal is crucial in this digital age, where transactions are increasingly moving online. Among the plethora of options, Wise, formerly known as TransferWise, stands out for its transparent, cost-effective, and efficient services. This article delves into what Wise is, how it works, its capabilities for online purchases, its utility for online casinos, practical tips for users, and additional insights to maximize its benefits.

What is Wise and How Does it Work?

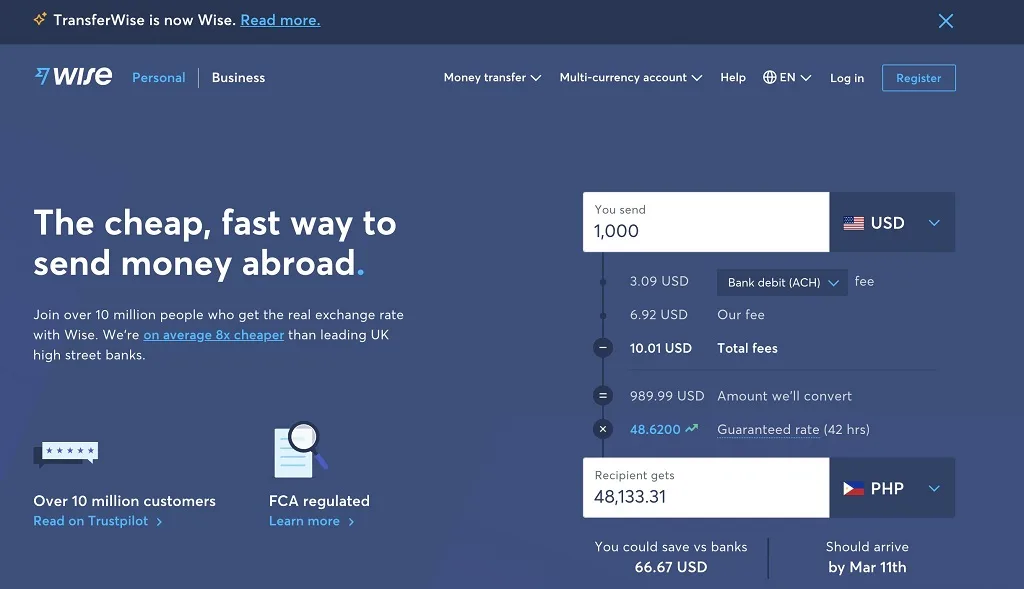

Wise is a revolutionary payment system designed to make international money transfers and currency exchange as straightforward and inexpensive as possible. Its unique selling proposition lies in its use of real exchange rates, also known as the mid-market rate, ensuring users are not burdened with hefty bank fees typically associated with currency conversion. Wise’s platform allows users to send money to over 80 countries, hold and convert between 56 currencies, and provide a debit card for spending abroad with minimal fees.

The process begins when a user initiates a transfer through the Wise website or mobile app. They enter the recipient’s details and the amount to be sent. Wise then instructs the sender to transfer the money to its bank account in the sender’s country. Once received, Wise uses its resources in the recipient’s country to send the equivalent amount to the recipient, thus bypassing expensive international bank transfer fees. This ingenious method not only reduces costs but also accelerates the transfer process, with many transactions being instant or completed within a day.

Is Wise Suitable for Online Purchases?

Online shopping has become a mainstay in our daily lives, necessitating a reliable and cost-effective payment method. Wise’s multi-currency account and debit card offer an appealing solution, especially for those who shop on international websites. Users can pay in the local currency of the online store, avoiding conversion fees typically charged by banks or credit card providers. Moreover, Wise’s transparency in fees ensures users know exactly how much they are paying, without any hidden costs.

For e-commerce businesses, accepting payments through Wise can be a game-changer. It allows businesses to receive payments in multiple currencies, reducing their exposure to fluctuating exchange rates. Additionally, Wise’s batch payment feature enables businesses to make multiple payments simultaneously, simplifying the payroll process for employees or contractors abroad.

However, it’s important to note that while Wise offers many advantages for online shopping, it might not be supported by all merchants. Therefore, checking the payment options on the website and considering Wise’s compatibility is advisable before proceeding with a purchase.

Can Wise Be Used to Top Up Online Casinos?

Online gambling is another sector where the flexibility and efficiency of payment methods are paramount. Wise’s attributes make it a potentially attractive option for funding online casino accounts. However, the acceptance of Wise by online gambling platforms varies. Some casinos welcome it for deposits due to its low fees and efficient transfers, while others may not support it directly.

For users looking to use Wise with online casinos not supporting it directly, one workaround is transferring funds from Wise to a bank account or a supported e-wallet first. Nevertheless, users should be cautious and verify the casino’s terms and conditions regarding payment methods to ensure compliance and avoid any inconvenience.

Furthermore, it’s crucial to remember that responsible gambling should be a priority, and users should only engage with reputable and licensed online casinos. Ensuring the platform’s legitimacy before transferring funds can protect users from potential scams.

Practical Tips for Using Wise

To maximize the benefits of Wise, users should consider several practical tips. Firstly, taking advantage of the multi-currency account by holding and converting money in different currencies can save significant amounts on conversion fees. Additionally, regularly checking the mid-market rate on Wise’s website ensures that users get the best deal on currency exchange.

Setting up alerts for favorable exchange rates can also be beneficial, allowing users to convert money when the rate is advantageous. For frequent travelers or those living abroad, the Wise debit card is a must-have, providing easy access to funds in the local currency at low costs.