EcoPayz — Is It Suitable for Casinos in Countries with Capital Controls?

In 2025, payment systems play a decisive role in shaping how players manage deposits and withdrawals in online casinos. Among the options available, EcoPayz has emerged as a reputable service for regions where financial transactions are tightly regulated. The question remains whether EcoPayz is a practical solution for casino users in countries with capital controls, where restrictions on cross-border payments are common. Let’s analyse its functionality, legal aspects, and practical implications for players and operators.

EcoPayz as a Financial Tool in Restricted Markets

EcoPayz, rebranded under the Paysafe Group, continues to serve users across more than 150 countries. It operates as an e-wallet that allows deposits, withdrawals, and transfers without the need to disclose full banking details to third parties. In regions with capital restrictions, this feature makes it particularly valuable, as it provides a secure bridge between a user’s local bank and international gaming accounts.

In 2025, countries such as Argentina, Turkey, and Nigeria still impose strict capital controls. Players in these markets often face limits on international card payments or bank transfers. EcoPayz’s structure — with multi-currency support and digital wallet independence — allows users to bypass such obstacles while remaining compliant with local financial laws.

However, the service’s effectiveness depends on national regulatory cooperation. Some countries now require digital wallet providers to report larger cross-border transfers. Therefore, while EcoPayz remains accessible, its usability for casino payments is directly tied to updated financial reporting standards.

Advantages of EcoPayz for Online Casino Users

EcoPayz stands out because of its user-friendly security architecture. Transactions are encrypted using the latest TLS technology, and accounts can be verified without physical documents through integrated ID-check systems. Players value its speed — deposits to casino accounts typically appear instantly, while withdrawals are processed within 24 hours.

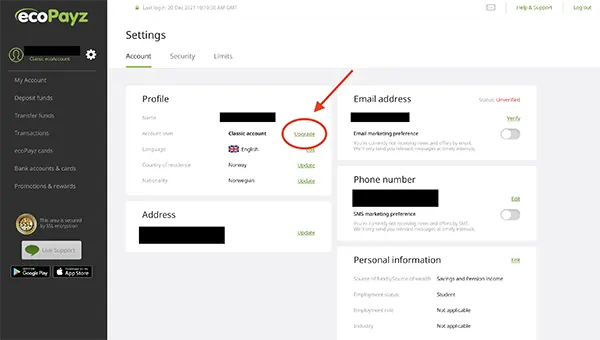

Additionally, EcoPayz supports multiple account tiers, offering higher transaction limits for verified users. This flexibility allows serious players and high rollers to operate within legal frameworks while maintaining financial privacy. The loyalty programme, known as EcoPayz VIP, provides reduced transfer fees and priority support — features that are increasingly appreciated in restricted financial environments.

Yet, it’s crucial to note that casino operators must also hold valid licences from jurisdictions that recognise EcoPayz as a compliant payment processor. Without this alignment, players might experience blocked transfers or delays in fund processing.

Regulatory Compliance and Limitations in 2025

In 2025, the European Union and the United Kingdom have reinforced Anti-Money Laundering (AML) and Know Your Customer (KYC) directives. EcoPayz has adapted by implementing real-time verification and transparent transaction monitoring. This makes it one of the few wallets accepted by licensed casinos in both Europe and parts of Asia.

Nonetheless, in countries where central banks strictly monitor outbound transactions — for example, China or India — EcoPayz’s usage is either limited or entirely blocked. In these areas, only local payment systems are permitted for online entertainment activities. Hence, even though EcoPayz offers technical compatibility, regulatory barriers may prevent full functionality.

Players are advised to consult local financial laws or contact EcoPayz support before initiating casino-related payments. Unauthorised use may lead to frozen funds or administrative penalties under local financial control laws.

How Casinos Adapt to Capital Restrictions Using EcoPayz

Online casinos targeting regulated regions have started implementing flexible payment structures. By integrating EcoPayz, they provide a compliant alternative to direct bank transactions. This model not only benefits players but also reduces administrative risk for operators handling international deposits.

Casinos often combine EcoPayz with secondary systems like Skrill or Neteller, ensuring redundancy if one service faces temporary suspension. This diversification strategy, popularised after the 2023 global regulatory updates, remains vital in maintaining financial continuity for users.

Moreover, many casinos now use automatic conversion tools to match EcoPayz balances to local currencies. This feature reduces exchange-rate losses and simplifies accounting in countries with fluctuating capital policies.

The Future of EcoPayz in Restricted Economies

EcoPayz’s development trajectory indicates a growing emphasis on compliance and transparency. By 2025, it has implemented blockchain-based auditing features, enhancing traceability and making the system more trustworthy for regulatory agencies. Such innovations strengthen its legitimacy in controlled markets.

For players, the main advantage lies in the continued independence from traditional banking infrastructure. As capital controls tighten globally, digital wallets like EcoPayz remain one of the few viable solutions for cross-border entertainment payments that don’t violate financial laws.

That said, each jurisdiction interprets “capital outflow” differently. While EcoPayz is compliant under EU and UK standards, users in other regions must verify whether digital wallet funding falls under foreign transaction restrictions.

Practical Recommendations for Players and Operators

Players should always ensure their EcoPayz accounts are verified and linked to legitimate casino operators. Choosing casinos regulated by authorities such as the Malta Gaming Authority or the UK Gambling Commission provides legal protection in case of disputes.

Operators, on the other hand, should maintain transparent communication with financial authorities and use AML-compliant gateways. This ensures that transactions via EcoPayz remain traceable and lawful, preserving both reputational and operational integrity.

In summary, EcoPayz can be a strong ally for users in countries with capital control policies, but only when used responsibly and in line with up-to-date financial regulations. As 2025 progresses, its hybrid approach — balancing user autonomy with strict compliance — may define the future of secure casino payments.