Dwolla Payment Platform: Revolutionizing Digital Transactions – A Review

Join us as we explore the intricacies of Dwolla, a digital payment solution that has been making waves in the fintech industry. This detailed review will shed light on the origins of Dwolla’s name, its widespread application, its potential use in the online casino industry, future prospects, and more.

Decoding the Origin of Dwolla’s Name

The name ‘Dwolla’ is derived from a combination of ‘Dollar’ and ‘Web,’ symbolizing the company’s mission to transform the traditional dollar transactions into a seamless web-based experience. Established with the vision of offering an efficient online payment system, Dwolla has been true to its name by simplifying financial transactions over the web.

Since its inception, Dwolla has stood out for its innovative approach to payments, offering a platform that integrates convenience, speed, and security, revolutionizing how businesses and individuals transfer money.

Where is Dwolla Used?

Business Transactions and E-commerce

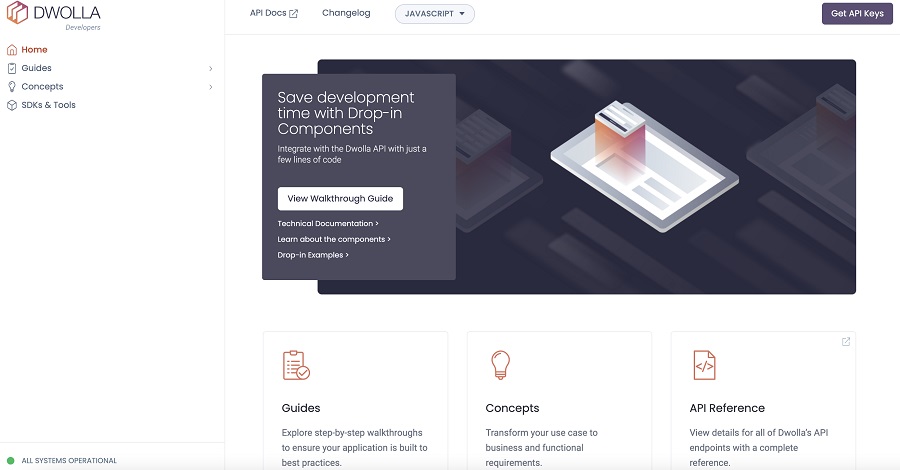

Dwolla’s versatile payment platform finds its use in various sectors, particularly in business transactions and e-commerce. Its API-driven approach allows for easy integration with different types of businesses, simplifying the process of sending and receiving payments.

Peer-to-Peer Transfers

Additionally, Dwolla facilitates efficient peer-to-peer transfers, making it a popular choice for users who prefer quick and hassle-free personal transactions.

Dwolla and Online Casinos: A Possibility?

As the online casino industry continues to grow, the integration of reliable payment methods like Dwolla becomes crucial. Dwolla’s potential for use in online casinos lies in its ability to process transactions swiftly and securely, an essential requirement for casino players. However, the adoption of Dwolla by online casinos would depend on various factors, including regulatory compliance and market demand.

The Future Prospects of Dwolla

Looking ahead, Dwolla’s innovative payment solutions and commitment to enhancing user experience position it well for future growth. The focus on developing advanced features like real-time payments and enhanced security protocols suggests promising prospects for Dwolla in the expanding digital payment landscape.

Concluding Thoughts on Dwolla’s Role in Digital Payments

In summary, Dwolla presents itself as a robust and user-friendly payment platform, capable of catering to diverse payment needs. Its continuous evolution and adaptation to market trends make it a valuable player in the realm of digital financial transactions.