CashtoCode: Single-Use Vouchers as a Secure Deposit Method

CashtoCode has become a practical deposit option for those who prioritise privacy and straightforward payments. By 2025, the service is available across many European regions and selected international markets, offering single-use vouchers that allow users to fund their accounts without sharing bank or card data. This approach appeals to customers who value discretion and reliability when making online transactions.

How CashtoCode Works

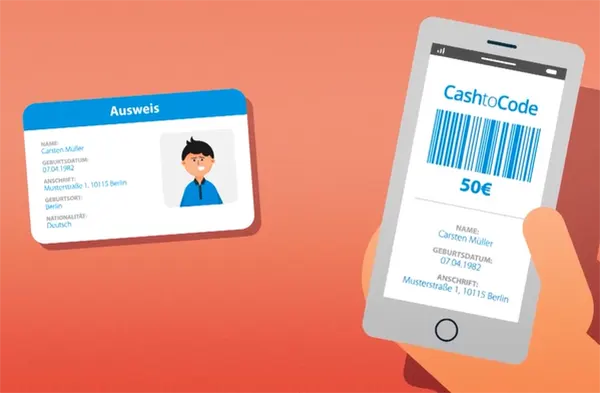

CashtoCode operates as a voucher-based payment method. A user purchases a one-time voucher at an authorised retail point and receives a unique code that can be used to complete a deposit online. The transaction is processed instantly, with no need for personal banking details. This simplicity has made the service an attractive option for those seeking a low-barrier method to transfer funds safely.

The service is designed for ease of use. The vouchers are available through thousands of retail partners and convenience stores across Europe. Once the voucher is purchased, the code is entered directly at checkout. There are no additional registration steps or account creation, reducing friction and supporting users who prefer to stay anonymous during financial transactions.

In 2025, CashtoCode supports multiple currencies and country-specific denominations. This allows users from different regions to purchase a voucher that suits local payment standards and limits. The system is aimed at those who want predictable and transparent payments without hidden charges.

Regional Availability and Key Markets

CashtoCode is primarily available in Germany, Austria, Ireland, the UK, and several Nordic and Central European countries. In recent years, distribution has expanded into selected non-EU markets through retail chains that specialise in digital payment products. Availability depends on national regulations, especially in areas where voucher-based methods require compliance with financial oversight.

Retail availability remains one of the service’s fundamental strengths. Users can purchase vouchers in supermarkets, fuel stations, electronic stores, and various licensed payment outlets. The distribution network continues to grow, with new partnerships forming in markets where demand for privacy-focused deposit methods has increased.

The service remains restricted in countries with stricter rules around prepaid payment instruments. In these regions, CashtoCode may offer alternative solutions such as barcode-based deposits, which require scanning at a physical retail partner without issuing a voucher code.

Advantages of Using CashtoCode

One of the primary advantages is anonymity. Users are not required to provide personal bank details, which reduces exposure to data misuse and unauthorised access. This aspect is particularly valued by those who avoid sharing sensitive financial information online. The vouchers offer controlled spending because each code has a fixed value and cannot exceed the purchased amount.

Another benefit is the simplicity of the process. CashtoCode eliminates the complexity that comes with other payment methods requiring identity verification or account linking. This makes the system accessible to a wide audience, including individuals who prefer cash-based financial habits and want to avoid lengthy verification procedures.

Instant processing is also a notable strength. Once the voucher code is entered, the transaction is completed in real time. This reliability makes the method appealing for users who need fast and predictable payments without delays. There are no maintenance fees, subscription charges, or recurring payments tied to the voucher.

Possible Limitations to Consider

Despite its convenience, CashtoCode has limitations. Withdrawals cannot be processed through vouchers, meaning users must choose a different method if they require payout options. This often requires sharing financial details, which may not align with the privacy-focused nature of the original deposit.

Another limitation is the need for physical access to a participating retailer. Users living in rural areas or regions with limited retail availability may find the system less practical. Although digital alternatives are developing, the core service still relies heavily on in-person purchases.

The fixed-value nature of vouchers can also be restrictive. They cannot be partially used or combined in unlimited quantities, depending on the rules of the service a user wishes to fund. Additionally, lost vouchers cannot be recovered easily, as they are single-use codes without personal registration.

Security Features and User Protection

CashtoCode includes several layers of security designed to prevent misuse and protect users’ funds. Voucher codes cannot be hacked or intercepted once redeemed, as they are processed through secure transaction channels. The absence of personal banking information also decreases the risk of identity theft.

The retail purchase process adds another protective element. Because the voucher is acquired in person, it avoids the vulnerabilities associated with online card payments. This method suits users who prioritise controlled, cash-based spending and want a predictable financial process.

In 2025, regulating authorities in Europe have strengthened oversight of prepaid instruments. CashtoCode complies with regional requirements, including anti-fraud measures and transaction verification procedures. These measures ensure that the service remains both transparent and safe for end users.

Who CashtoCode Is Best Suited For

CashtoCode is well suited to individuals who prefer to manage their budget manually. The fixed voucher amounts make it easy to control spending and avoid unexpected charges. This approach appeals to users who rely on prepaid solutions instead of bank cards.

It is also a strong option for people who want to protect their personal information online. Since the system does not ask for card numbers or banking details, it reduces unnecessary exposure of sensitive data. This benefit has increased its popularity in regions where cybersecurity concerns are rising.

Finally, it is effective for those who want a fast and straightforward deposit method. With no registration steps and instant processing, CashtoCode ensures predictable transactions that require minimal technical knowledge.