Paytm — How to Top Up a Casino Account via Paytm Wallet and UPI (2026 Guide)

Paytm is still one of the most familiar payment apps in India, but using it for casino deposits is rarely “one-click simple”. The practical choice usually comes down to Paytm UPI (a bank-to-merchant transfer) versus Paytm Wallet (a stored-value balance with KYC-based limits). On top of that, payment providers and banks often apply strict risk rules to gambling-related transactions, so you need to understand what can realistically work, what typically fails, and what your withdrawal options look like before you deposit.

Paytm Wallet vs Paytm UPI: what you’re actually using when you pay

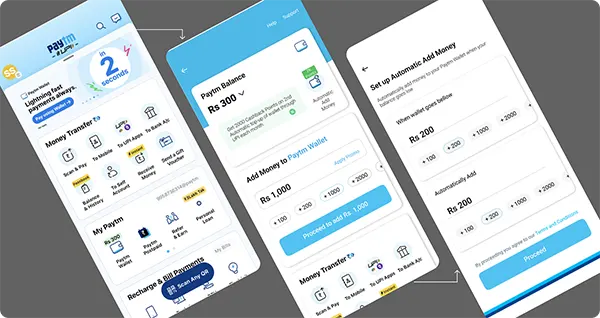

Paytm Wallet is a prepaid balance inside the Paytm app, and its usage depends heavily on your KYC level. Paytm itself describes “minimum KYC” versus “full KYC” wallets, where the available features and limits change based on verification status. In practice, a wallet is best thought of as “money already sitting inside Paytm”, which you then spend with supported merchants or services.

Paytm UPI is different: it routes your payment through the UPI system from a linked bank account. This means the bank’s rules matter more than Paytm’s wallet rules. UPI payments typically use a collect request or a UPI intent flow, and approvals happen in-app. UPI is also where you’ll most often see per-transaction and daily caps (commonly up to ₹1,00,000 for many standard payment types), with higher caps in some categories depending on bank and use case.

The post-2024 Paytm ecosystem also matters. After regulatory actions against Paytm Payments Bank, Paytm’s UPI operations were moved to a multi-bank setup as a third-party app provider (TPAP), using partner banks for UPI processing. So in 2026, when you pay via Paytm UPI, the “bank layer” may be one of Paytm’s partner PSP banks rather than Paytm Payments Bank itself, depending on how your account is set up in the app.

Quick decision rules for casino payments

If a casino offers a UPI option that works with Paytm, UPI is usually the cleaner path: the money comes directly from your bank and there’s no extra step of maintaining a wallet balance. It can also reduce the “where did the funds come from” friction later, because withdrawals are commonly sent back to a bank account rather than to a wallet balance.

Use Wallet only if you already have a usable balance and the merchant routing accepts wallet transactions. This is where many players get stuck: even when a site shows “Paytm” as a method, the underlying payment routing may actually be UPI, not wallet, or it may be blocked by the payment gateway’s risk controls for gambling-related merchants.

Finally, treat any “Paytm Wallet top-up” claim with caution. Paytm has published guidance that certain wallets could be used for spending existing balance after March 15, 2024, but adding money was restricted for affected cases. For casino deposits, that means Wallet can be unreliable as a funding source in the real world unless your setup is clearly able to add funds and the payment rails allow it.

KYC, verification steps, and why they matter for deposits and withdrawals

For Paytm Wallet, KYC is the gatekeeper. Paytm explains that wallet benefits and restrictions are tied to whether you are on minimum KYC or full KYC. If you’re trying to use a wallet for repeated deposits, a low-verification state often becomes a bottleneck: smaller limits, more frequent checks, and higher odds of a transaction being declined when a merchant category is considered higher risk.

For Paytm UPI, KYC sits primarily with your bank and your UPI onboarding. In plain terms: if your bank account is fully compliant and your UPI handle is active, UPI transactions are less about “Paytm wallet KYC” and more about bank-side risk rules, caps, and security checks. Paytm has also explained that UPI limits exist for safety and that caps can vary by payment type, bank policy, and user history.

Casino-side verification is the second layer you must plan for. Many operators require that withdrawals go back to a method in your name. Even if you deposited via UPI, the casino may still insist on identity checks and may refuse to pay out to a different beneficiary. The practical result is simple: do your Paytm and bank verification first, then complete the casino’s identity checks early, before you attempt a larger deposit.

What “KYC done” should mean in a realistic 2026 checklist

On the Paytm side, you want your account verified to the highest level available to you, and you should ensure your linked bank account is stable and in your own name. If you rely on UPI, confirm your UPI ID is active, your bank account is not restricted, and your daily transaction headroom is enough for your typical deposit size.

On the casino side, complete verification (identity, address if required, and proof of payment method where applicable) before chasing withdrawals. A common pain point is depositing first, winning, and only then learning that the casino wants additional documents, or that it will only withdraw to a bank transfer channel you didn’t plan for.

Keep names consistent. If your casino profile name doesn’t match your bank/UPI identity, you increase the odds of manual review, delays, or a rejected payout. This is especially true when payment providers treat gambling-related activity as higher risk and route transactions through extra checks.

Fees, limits, and typical restrictions on gambling-related payments

In many cases, Paytm UPI itself does not add an explicit “UPI fee” for standard transactions, but your bank and the merchant’s payment processor rules still determine whether a transaction is allowed. Paytm’s own UPI guidance highlights that limits and controls are designed for security, and in practice you’ll see caps such as ₹1,00,000 per transaction or per day for many standard UPI flows, with different caps in certain categories depending on the system rules and bank configuration.

For Wallet, the bigger issue is often not a visible fee but whether you can add funds at all and whether the merchant routing accepts wallet payments. Paytm has publicly stated that some wallet users could keep using existing balance after March 15, 2024, while adding funds was not available in affected cases. That detail is important because a wallet that cannot be topped up cannot be your primary deposit method, even if it still “works” for spending what’s already there.

Now the casino-specific reality: gambling payments are frequently blocked or throttled by banks, payment gateways, or merchant risk controls. Even when a cashier page shows “UPI” or “Paytm”, the transaction can fail due to merchant category rules, compliance flags, or bank risk scoring. That’s why “it worked once” does not guarantee repeat success, and why smaller test deposits are the sensible approach when using any higher-risk merchant routing.

How to reduce failed transactions without guessing

First, keep deposit sizes aligned with common UPI caps. If you try to push a large amount in one go, you can hit limits or trigger extra checks. A short test deposit confirms whether the merchant routing is currently accepted before you move larger sums.

Second, prefer UPI over Wallet when the casino supports it cleanly, because it reduces the number of moving parts. With Wallet you have “wallet funding rules” plus “merchant acceptance rules”. With UPI, you mainly have “bank rules” plus “merchant acceptance rules”. Fewer layers usually means fewer unexpected declines.

Third, plan the withdrawal route before you deposit. Many casinos that accept local deposits via UPI do not always offer the same local method for withdrawals, especially if they use third-party processors or cross-border payment routing. If the only realistic cash-out option is bank transfer, make sure that option is available to you and that your casino account details match your bank details.