Alipay: The Chinese Giant and Its Potential in iGaming Beyond China

Alipay is one of the largest digital financial services globally, and in recent years it has expanded significantly beyond mainland China. For the iGaming sector, this development opens new opportunities, particularly in the context of Asia’s growing influence in the gambling market. Operated by Ant Group, Alipay provides access to millions of users seeking secure and familiar payment methods. This article explores how Alipay is being applied in iGaming, its capabilities, functionality, and compliance with international requirements.

Alipay in International Casinos Targeting the Asian Market

Today, many online casinos are adapting their services to players from China, Singapore, Malaysia, and other Asian countries. Alipay plays a central role in this strategy by offering a widely recognised and trusted payment method. With Alipay integration, gambling sites can serve players in a seamless way, eliminating the need for currency conversions or unfamiliar interfaces.

Alipay is supported not only by global casino operators but also by brands specifically focusing on Asian audiences. In many cases, its usage is incentivised with bonuses or promotions tailored to users who choose this payment method.

For gaming businesses, offering Alipay can serve as a competitive advantage, especially in mobile-first markets where transaction convenience is essential.

Integration of Alipay: Technical and Commercial Aspects

From a technical perspective, Alipay can be integrated through APIs provided by Ant Group’s official partners. These APIs support real-time transactions, payment authentication, and identity verification features aligned with global KYC requirements. The process includes legal agreement onboarding and sandbox testing for business accounts.

Commercially, it’s important to understand the limitations — Alipay does not officially permit gambling-related payments in mainland China. However, services targeting Chinese citizens abroad (e.g., in Singapore or the EU) may operate with Alipay legally.

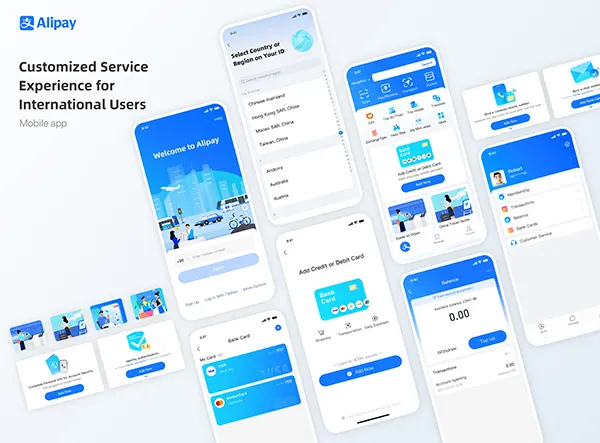

Integration also includes frontend payment interface design, QR code generation, mobile app authorisation, and multi-currency support, including transactions displayed in CNY or local currencies.

Security, Monitoring, and Transaction Limits

Alipay places strong emphasis on security. All transactions are protected via two-factor authentication and continuous fraud detection. For iGaming operators, this translates into user trust and smoother payment experiences.

Transaction limits depend on user account levels and regional settings. Daily caps can range from ¥10,000 to ¥50,000 equivalent. Online casinos can also impose internal limits to promote responsible gambling.

The platform supports refund capabilities, enabling payment reversals in cases of technical errors or cancelled game sessions — particularly important in live casino environments.

Alipay’s Compliance with AML and KYC Regulations

Alipay adheres to global Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. This includes mandatory identity verification for users exceeding transaction thresholds or operating from high-risk regions.

For operators, compliance is essential. Failure to meet AML/KYC standards may result in suspended accounts, withheld funds, or rejection by Acquiring Partners. Many iGaming software providers include built-in compliance features to facilitate this.

Ultimately, Alipay contributes to greater transparency in payment flows — an essential factor for sustainable and reputable gambling operations in regulated markets.

Business Advantages and Future Growth Potential

For online casino operators, Alipay provides access to a massive base of financially active users. With over 1 billion Alipay accounts — many used by tourists, students, and expatriates — the payment option bridges gaps between markets and cultures.

Familiarity with the system boosts deposit conversion rates, lowers customer support costs, and strengthens retention. It also signals trustworthiness to users familiar with Alipay, particularly in Asian markets.

As interest in Southeast Asia’s gambling industry rises, and with jurisdictions becoming more open to multi-currency environments, Alipay is positioned to become a key enabler in cross-border payment ecosystems.

Key Considerations Before Launching Alipay Integration

Before implementing Alipay, operators should consider legal frameworks. Some jurisdictions require a separate financial licence for handling Chinese payment processors. Local regulations must also be reviewed to avoid non-compliance.

It is strongly advised to work with legal advisors or certified integration agencies experienced in Alipay’s framework. This ensures that the integration process meets security standards and business goals without account risks.

Successful integration also includes content localisation, Chinese language support, culturally adapted marketing, and optimised mobile UX — all of which are key in targeting the Alipay-using audience effectively.